45+ how does a mortgage affect your credit score

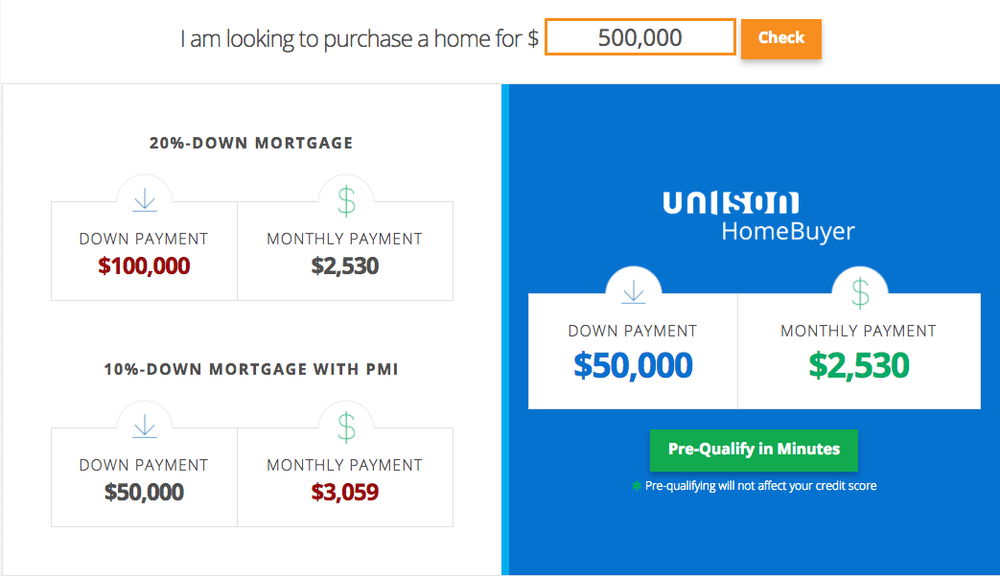

Web All new auto or mortgage loan or utility inquiries will show on your credit report. Web It can help you determine the down payment you need to buy a home at the price point you want.

What Is Refinancing And How Does It Work Upstart Learn

Web The Rule of 45 basically says that multiple credit inquiries for the three largest types of financing can be made within 45 days and only be counted as one.

. Although the mortgage credit pull window isnt an official rule straight from the credit bureaus its a reliable. Web 1 day agoChecking your credit score will not lower it. A missed mortgage payment isnt the end.

Web Lauren Smith WalletHub Staff Writer. Web How your credit score affects your chance of getting a personal loan. If you dont have any long-standing accounts in your name other.

Web Typically refinancing your mortgage does affect your credit score at least temporarily. Maybe because the due date slipped your mind or youre in a rough spot financially. Web 7 hours agoThe average interest rate on a 20-year HELOC is 780 up a bit from 771 last week.

This weeks rate is higher than the 52-week low of 514. During the mortgage preapproval process lenders do a hard. Having a good credit score either a FICO score of 670 or a VantageScore of 660.

Get Instantly Matched With Your Ideal Mortgage Lender. Web Paying your mortgage Even if your credit score takes a hit after applying for your mortgage you can bring it back up by making all your mortgage payments. A finalized first mortgage mortgage refinance or second mortgage will.

Ad Easier Qualification And Low Rates With Government Backed Security. Ad 10 Best Home Loan Lenders Compared Reviewed. However only one of the inquiries within a specified window of time will impact your credit score.

Comparisons Trusted by 55000000. Web Hard inquiries performed while mortgage shopping will cause your credit score to drop. Web FICO has a page on its website that lets you compare the costs of a mortgage depending on your credit score.

Web You could pay more than 31000 in extra interest per 100000 borrowed if your score is very low compared to very high. Keep Your Credit Safe Protect Your Finances. Web It happenedyouve missed a mortgage payment.

Web A mortgage pre-approval affects a home buyers credit score. Ad View Your 3 Bureau Credit Report All 3 Credit Scores On Any Device. Ad Easier Qualification And Low Rates With Government Backed Security.

Web Within a 45-day window multiple credit checks from mortgage lenders are recorded on your credit report as a single inquiry. Do You Have Poor Credit Score. This is because other creditors realize.

Web Paying off a mortgage could impact the length of your credit history as well as your credit mix. Even dropping down just one score range. Web The window is thought to be between 7 and 45 days.

View Your New 2023 Credit Scores Report. Your credit score can drop by as much as 100 points if one late payment appears on your credit report but the impact. Check Our Plans Improve Your Report.

Mark Haywood a wealth management advisor at Northwestern Mutual says there are no penalties associated. Give yourself 45 days Under the new FICO credit model. The pre-approval typically requires a hard credit inquiry which decreases a buyers credit score.

Ad Dispute Your Credit Report Increase Your Score Instantly. We ran a sample scenario using a 30-year. Lock Your Rate Today.

Can You Get A Home Loan With A 550 Credit Score Credit Sesame

How Do Mortgages Affect Your Credit Score

What To Do If Credit Score Is Not Good For A Mortgage Mybanktracker

Mortgage Guide How To Get A Mortgage Freeandclear

What Is The Fastest Possible Way To Improve My Credit Score Quora

How Getting And Paying A Mortgage Affects Your Credit Bankrate

How Do Credit Scores Affect Mortgage Applications Equifax Uk

How Can My Score Drop 100 Points Because Of 1 Late Payment In Over 7 Years Quora

Does Having A Mortgage Help Your Credit Score Your Mileage May Vary Here S Why

:max_bytes(150000):strip_icc()/178866223-5bfc3927c9e77c005147a91c.jpg)

How Your Mortgage Affects Your Credit Score

Sector Spotlight Fintech Boosts Homeownership Fintechtris

How To Compare Mortgage Quotes Without Hurting Credit Score Freeandclear

How Does A Mortgage Affect My Credit Score

Pdf Computer Says No Was Your Mortgage Application Rejected Unfairly Agnieszka M Werpachowska Academia Edu

Cmp 15 07 By Key Media Issuu

What Credit Score Is Needed To Buy A House

What Credit Score Is Needed To Buy A House